2021 Supply Chain Shock – Second Wave Update - August 21

Global media coverage surrounding COVID-19 outbreaks provide us with valuable and often detailed information around public health and the initiatives to curtail the spread of the virus. We at ITM wish to add our commentary around the current impact we are observing in the global supply chain through the representation of our clients interests around the world.

Current Situation: What we are observing:

Demand:

- Global demand seems to have stabilised as shipping lines report the volume of containers moved closely resemble 2019 volumes so far in Q3. This has not translated to any relief in pricing or reliability of service by the shipping lines. Now we have congestion and the Delta variant to thank for continued disruptions and inflated pricing.

Congestion:

- Remains one of the two biggest problems at the moment, Shipping lines require more resources in order to move the same amount of freight due to the productivity lost idly waiting at port for prolonged periods due to congestion.

- Ports in China, EU and US continue to experience major delays due to volume, weather and the Delta variant.

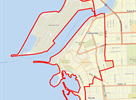

- Closer to home Sydney is experiencing delays of approx. 7 days whilst Auckland is still out to 8-14 days.

- Recent weather events in China have seen lengthy delays across most ports, but specifically in the ports of Shanghai and Ningbo. We are only half way through the typhoon season in China that generally runs through to the end of September, so please bear this in mind.

Delta Variant:

- This is the other biggest problem at the moment. It seems this variant is not content to disrupt our lives at close quarters here in Australia but rather it extends its reach globally to disrupt our supply chains and your cargo. We are seeing restrictions and factory closures over the last few days across Vietnam, Korea, Malaysia, Japan, Thailand and China. Presently 17 provinces in China have had restrictions placed on them over the weekend impacting some factories and delaying inland trucking. Overnight we have had word that a terminal in Ningbo has been closed due to a positive case, although at this point it is only one terminal and not the whole port, it is still a concerning development. We brace for the fallout with the thought of Yantian port closure a little over 2 months ago and the chaos that ensued. Immediately we have seen a delay in the request for pricing and bookings on scheduled services due to the outbreak. Chinese authorities have publicly stated that halting the spread of the virus is a “Top Priority”, so be prepared for more supply chain disruptions. Keep lines of communications open with your suppliers as to their individual status.

- We can only see more of the same whilst congestion and the threat of the Delta variant persists, resulting in disruption to schedules and more opportunity for shipping lines to increase pricing and surcharges.

- Due to Victoria halving international arrivals this has had an impact on the availability of international flights, with closed international borders any reduction in capacity will impact price and availability.

- Due to the Delta variant outbreak in China, China have already suspended some cargo flights and scheduled charter flights putting further pressure on scheduled flights.

Our Advice: Remains unchanged

Expect rates and capacity to continue to deteriorate over the coming months due to congestion and the Delta variant. Early dialogue with your customers regarding delays should serve you well especially for goods ex China as halting the virus is “Top Priority”. Again, do not make any unrealistic promises regarding into store dates, this Delta variant and its impacts are making international headlines so your clients will become aware of these impacts if they are not already.

We offer our experiences/observations in order you are aware of the impact on the International supply chain and what this means for your orders/production and the impact on your clients.

Rest assured that any developments will be shared with you, but in the meantime feel free to contact your ITM representative with any specific questions you may have.

John Antoniou

Chief Executive Officer

-

Australian Governments Modern Manufacturing Strategy

-

Boxship owners see 13-year high in charter rates as carriers hunt for tonnage

-

DP World and UNICEF to support COVID-19 vaccine distribution

-

Buoyant ocean carriers set to roll out peak season surcharges months early

-

Trade protectionism a barrier to the recovery of global economies, warns ICS

-

Outlook for large widebody looks chilly in a hot freighter conversion market

-

EVEN AS THE WORLD STRUGGLES

-

Maersk to launch carbon neutral vessel

-

STATE PREMIERS URGED TO INTERVENE ON CROSS-BORDER ISSUES

-

PORT BOTANY RAIL DUPLICATION FAST TRACKED

-

Covid vaccine: is air cargo ready for 'the biggest product launch in history?

-

Logistics protests as Melbourne lockdown puts the brakes on supply chains

-

Demand driving transpacific prices sky high, with Asia-Europe benefiting too

-

Carriers follow through with capacity disicpline and blank more sailings

-

Indonesian Free Trade Agreement - economic opportunity opens up

-

Department of Agriculture turns away import vessel

-

Good Compliance Update - December 2019

-

Scale-less weighing of containers for SOLAS VGM

-

Patrick East Swanson Terminal Melbourne - Reductions in night shift road R&D operations

-

Shippers brace for delays as coronavirus keeps China's factories closed

-

Coronavirus containment measures and the impact on your China cargo.

-

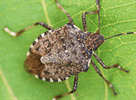

2019/2020 Stink bug seasonal requirements

-

BAF calculator may help ease uncertainty over looming IMO 2020 fuel rule

-

From 15 to 5 in just a few years - shippers' declining choice of container carriers

-

Government money to boost Queensland export

-

Freight forwarding scam warning

-

Marine insurance case study

-

Australian Ports infrastructure not keeping up with global trends

-

Truckies heartened by support to stopping port surcharges

-

Victorian Transport Association (VTA) State Conference 2019 - Making the case for inland rail

-

Protection from tariffs a feature of Australia and Hong Kong deal.

-

BMSB UPDATE 45 - WA Biosecurity Alert