Carriers follow through with capacity disicpline and blank more sailings

Ocean carriers are continuing with their “cautious” approach to capacity management, announcing a new series of blanked sailings in October.

Both the 2M and THE alliances have withdrawn headhaul capacity in weeks 40 to 44 to mitigate expected reduced demand due to the Chinese Golden Week holiday, the first week of next month.

Alphaliner said that, notwithstanding that September “will be a strong month for the carriers”, their decision to avoid overcapacity in October proved they had “mastered the art of fine-tuning their capacity to match it with market demand”.

The consultant added: “The disastrous effects of previous rate wars, and the operational mess following the collapse of the Korean carrier Hanjin Shipping in 2016, have not been forgotten.

“The good results of the carriers are, of course, not only the result of disciplined capacity management, which is new to the liner industry, but also largely influenced by the fact that bunker prices have dropped considerably.”

THEA will blank the sailing of its FE2 loop by the 19,870 teu Al Zubara in the first week of October and the second voyage of newbuild 23,820 teu HMM Rotterdam on the FE3, scheduled to sail from Asia in the week beginning 5 October.

In addition, October will see the continued blanking of THEA’s FE4 loop, which will not be replaced by the ‘extra loaders’ deployed in August and this month.

Meanwhile, the 2M has reacted to the peak demand prior to the Golden Week holiday by introducing ULCVs, such as the 19,437 teu MSC Erica and the 18,340 teu sister ships Marchen Maersk and Maribo Maersk, on its seasonal Asia-Europe AE55/Griffin ‘sweeper’ service, which was previously serviced by 14,000 teu tonnage, noted the consultant.

However, during October, the first three sailings of the AE55/Griffin loop will be blanked, in addition to the continued suspension of the AE2/Swan loop through the month.

“The Ocean Alliance has not formally announced a blanking scheme yet, but the latest schedules show three skipped sailings in Asia-North Europe loops, whereas a fourth sailing will be cancelled as the Evergreen-operated CES/NEU7 service will only offer two departures in three weeks with a ten-day interval,” said Alphaliner.

According to eeSea data, at the peak of the Covid lockdown demand slump in May, carriers withdrew 19% of sailings from Asia on the transpacific and cancelled 28% of their scheduled departures to Europe.

However, despite criticism that they over-reacted with their blanking programmes, carriers have not only reinstated many of the voided loops, but added extra loaders and sweeper services on the tradelanes.

Indeed, according to an analysis by Sea-Intelligence, capacity deployed between Asia and the US west coast is currently some 15% higher than for the same weeks of 2019.

-

Australian Governments Modern Manufacturing Strategy

-

Boxship owners see 13-year high in charter rates as carriers hunt for tonnage

-

DP World and UNICEF to support COVID-19 vaccine distribution

-

Buoyant ocean carriers set to roll out peak season surcharges months early

-

Trade protectionism a barrier to the recovery of global economies, warns ICS

-

Outlook for large widebody looks chilly in a hot freighter conversion market

-

EVEN AS THE WORLD STRUGGLES

-

Maersk to launch carbon neutral vessel

-

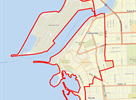

STATE PREMIERS URGED TO INTERVENE ON CROSS-BORDER ISSUES

-

PORT BOTANY RAIL DUPLICATION FAST TRACKED

-

Covid vaccine: is air cargo ready for 'the biggest product launch in history?

-

Logistics protests as Melbourne lockdown puts the brakes on supply chains

-

Demand driving transpacific prices sky high, with Asia-Europe benefiting too

-

Carriers follow through with capacity disicpline and blank more sailings

-

Indonesian Free Trade Agreement - economic opportunity opens up

-

Department of Agriculture turns away import vessel

-

Good Compliance Update - December 2019

-

Scale-less weighing of containers for SOLAS VGM

-

Patrick East Swanson Terminal Melbourne - Reductions in night shift road R&D operations

-

Shippers brace for delays as coronavirus keeps China's factories closed

-

Coronavirus containment measures and the impact on your China cargo.

-

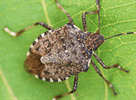

2019/2020 Stink bug seasonal requirements

-

BAF calculator may help ease uncertainty over looming IMO 2020 fuel rule

-

From 15 to 5 in just a few years - shippers' declining choice of container carriers

-

Government money to boost Queensland export

-

Freight forwarding scam warning

-

Marine insurance case study

-

Australian Ports infrastructure not keeping up with global trends

-

Truckies heartened by support to stopping port surcharges

-

Victorian Transport Association (VTA) State Conference 2019 - Making the case for inland rail

-

Protection from tariffs a feature of Australia and Hong Kong deal.

-

BMSB UPDATE 45 - WA Biosecurity Alert