Boxship owners see 13-year high in charter rates as carriers hunt for tonnage

Containership charter rates have hit 13-year highs and shipowners are locking these in with carriers on three- and five-year charters.

Alphaliner says the supply of container tonnage “remains tight across the board” as unrelenting cargo demand and chronic port congestion tie up the world’s box ship fleet.

The consultant’s Charter Rate Index has reached its highest level in 13 years and it said that with the outlook bullish for owners, they would “retain the upper hand for some time”.

Indeed, one London broker source told The Loadstar he couldn’t remember seeing such a swing in the market in favour of the owner.

“Our owners are refusing to even consider talking about charter extensions of less than 24 months, at much higher rates of course,” he said.

“The German shipowners can put their feet up all summer and probably next, and if the Eisbeinessen [shipping industry event] gets going again this year there is going to be one hell of a party in Hamburg!” he added.

Recent extensions noted include the 3,421 teu Nordic Macau, extended by CMA CGM for 22-25 months at $21,500 a day, compared with a previous fixture with Hamburg Süd at $7,250.

And Zim is said by brokers to be prepared to pay “whatever it takes” to secure tonnage to support its growth strategy. The Israeli carrier recently beat liner rivals to charter the 6,800 teu wide-beam Kea for36 months at $38,500 a day, compared with the $21,500 paid for the 2013-built ship by intra-Asia specialist Wan Hai on its previous fixture.

Zim has also extended its charter of the 8,814 teu Northern Jasper by five years at an undisclosed rate, after paying $29,000 a day for a one-year extension. A broker source told The Loadstar the new rate was likely to be “off the scale”, while another said that he had heard $45,000 a day being offered for the 2009-built ship.

The Hamburg and Bremen Shipbrokers’ Association said there had been “a real paradigm shift in favour of the owner”, which will not be especially welcomed by its members.

Meanwhile, carriers with deep pockets continue to search the sale and purchase market for tonnage. Alphaliner said: “MSC’s appetite for second-hand container tonnage appears endless,” and noted its reported purchase of a further three handy containerships to add to its fast-growing fleet.

“These purchases bring the number of vessels MSC has purchased since August to 31 – an unprecedented buying spree,” said Alphaliner.

Reference:

-

Australian Governments Modern Manufacturing Strategy

-

Boxship owners see 13-year high in charter rates as carriers hunt for tonnage

-

DP World and UNICEF to support COVID-19 vaccine distribution

-

Buoyant ocean carriers set to roll out peak season surcharges months early

-

Trade protectionism a barrier to the recovery of global economies, warns ICS

-

Outlook for large widebody looks chilly in a hot freighter conversion market

-

EVEN AS THE WORLD STRUGGLES

-

Maersk to launch carbon neutral vessel

-

STATE PREMIERS URGED TO INTERVENE ON CROSS-BORDER ISSUES

-

PORT BOTANY RAIL DUPLICATION FAST TRACKED

-

Covid vaccine: is air cargo ready for 'the biggest product launch in history?

-

Logistics protests as Melbourne lockdown puts the brakes on supply chains

-

Demand driving transpacific prices sky high, with Asia-Europe benefiting too

-

Carriers follow through with capacity disicpline and blank more sailings

-

Indonesian Free Trade Agreement - economic opportunity opens up

-

Department of Agriculture turns away import vessel

-

Good Compliance Update - December 2019

-

Scale-less weighing of containers for SOLAS VGM

-

Patrick East Swanson Terminal Melbourne - Reductions in night shift road R&D operations

-

Shippers brace for delays as coronavirus keeps China's factories closed

-

Coronavirus containment measures and the impact on your China cargo.

-

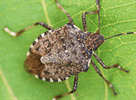

2019/2020 Stink bug seasonal requirements

-

BAF calculator may help ease uncertainty over looming IMO 2020 fuel rule

-

From 15 to 5 in just a few years - shippers' declining choice of container carriers

-

Government money to boost Queensland export

-

Freight forwarding scam warning

-

Marine insurance case study

-

Australian Ports infrastructure not keeping up with global trends

-

Truckies heartened by support to stopping port surcharges

-

Victorian Transport Association (VTA) State Conference 2019 - Making the case for inland rail

-

Protection from tariffs a feature of Australia and Hong Kong deal.

-

BMSB UPDATE 45 - WA Biosecurity Alert