Update: COVID19 & The MADNESS on the High Seas.

Global media coverage surrounding the COVID19 outbreak provides us with valuable and often detailed information around public health and the initiatives to curtail the spread of the virus. We at ITM wish to add our commentary around the current impact we are observing in the supply chain through the representation of our clients interests around the world.

Current Situation, Update:

As we witness second and third waves break out across the world we again brace for the impact these events will have on order fulfillment as factories reduce capacity and close under directives of their governments.

Orders ready to be shipped face the prospect of delays and inflated pricing such that the market has never witnessed. If you were lucky enough to maintain stock levels you will ride out this madness with little impact, but for most, delays in supply and increased domestic consumption has left stock levels depleted and the prospects of supply to meet demand before the festive season peaks is fading into an expensive nightmare.

Our advice is to have open dialogue with your clients as to your current supply situation, all the major retailers, manufacturers and supermarkets are very aware of the crazy situation with International logistics at the moment, as they too are also caught up with their own supply chain issues. Our range of clients encompass Multinational Organizations, SME’s and mum & dad operators, not a day goes by without an urgent call for help from our client base and others who have been referred to us suffering the same fate of having their goods stuck all over the world.

Sea freight:

Did COVID19 break Sea freight? Or was it the conscious decisions of the shipping lines in response to their own commercial agenda. Debate will rage as to what caused it, I prefer to expend my energy advising the very people relying on these services on what we are seeing, how long we see this lasting and what we can do to minimise the impact. The movement of containerised freight was to provide a timely, regular and cost effective way to facilitate the global movement of goods, it clearly is not doing this.

Currently what we are seeing is

- Canceled Sailings

- Congestion at Ports causing long delays

- Congestion Surcharges USD300 per container

- Ports being Bypassed by vessels

- Lack of Empty Containers to load at origin

- Overflowing empty containers parks at destination

- Industrial Unrest at AU Ports

- Containers being offloaded at OTHER ports, not destination Ports

- Offloaded containers left to Clients to transport to destination at their own cost or face lengthy delays for the lines to fulfil their contract and move to destination (3weeks from SYD to BNE on 1 occasion and 6 weeks from MEL to SYD on another)

- Delayed Sailing and Arrivals due to a bad Typhoon season

- Rates at unprecedented levels almost 50% higher than last year

- Cancellation of Bookings

This is not only impacting our clients here in Australia, but these same situations are currently being experienced in the UK, USA and EU.

We are confident this will not last forever, but we are also confident that it will last long enough to impact global trade through to February 2021 when traditional trade patterns show enough of a decline for the shipping line operators to get their houses in order.

Airfreight:

With the lack of capacity due to International border restrictions still hampering capacity and inflating prices we have seen some relative calm and stability in pricing, but I fear this is all about to change. Due to the issues experienced with sea freight we are anticipating a large move to airfreight as clients make realisations they will not meet critical deadlines and will have to rely on airfreight for a potential solution.

Our advice is to critically consider this option sooner rather than later as capacity will disappear in a heartbeat and rates will skyrocket before the month is out. Keep in mind my earlier recommendation, talk to your clients and discuss the possibility of not meeting deadlines due to these unforeseen GLOBAL circumstances, do this sooner rather than later, again they are not unfamiliar with your plight and it may just save you the cost and heartache of searching for an airfreight solution, paying premium prices and then having to wait for uplift.

We offer our experiences/observations in order you are aware of the general impact on the International Supply Chain and what this means for your orders/production and the impact on your clients.

Rest assured that any developments will be shared with you, but in the meantime feel free to contact your ITM representative with any specific questions you may have.

-

Australian Governments Modern Manufacturing Strategy

-

Boxship owners see 13-year high in charter rates as carriers hunt for tonnage

-

DP World and UNICEF to support COVID-19 vaccine distribution

-

Buoyant ocean carriers set to roll out peak season surcharges months early

-

Trade protectionism a barrier to the recovery of global economies, warns ICS

-

Outlook for large widebody looks chilly in a hot freighter conversion market

-

EVEN AS THE WORLD STRUGGLES

-

Maersk to launch carbon neutral vessel

-

STATE PREMIERS URGED TO INTERVENE ON CROSS-BORDER ISSUES

-

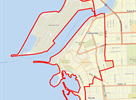

PORT BOTANY RAIL DUPLICATION FAST TRACKED

-

Covid vaccine: is air cargo ready for 'the biggest product launch in history?

-

Logistics protests as Melbourne lockdown puts the brakes on supply chains

-

Demand driving transpacific prices sky high, with Asia-Europe benefiting too

-

Carriers follow through with capacity disicpline and blank more sailings

-

Indonesian Free Trade Agreement - economic opportunity opens up

-

Department of Agriculture turns away import vessel

-

Good Compliance Update - December 2019

-

Scale-less weighing of containers for SOLAS VGM

-

Patrick East Swanson Terminal Melbourne - Reductions in night shift road R&D operations

-

Shippers brace for delays as coronavirus keeps China's factories closed

-

Coronavirus containment measures and the impact on your China cargo.

-

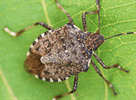

2019/2020 Stink bug seasonal requirements

-

BAF calculator may help ease uncertainty over looming IMO 2020 fuel rule

-

From 15 to 5 in just a few years - shippers' declining choice of container carriers

-

Government money to boost Queensland export

-

Freight forwarding scam warning

-

Marine insurance case study

-

Australian Ports infrastructure not keeping up with global trends

-

Truckies heartened by support to stopping port surcharges

-

Victorian Transport Association (VTA) State Conference 2019 - Making the case for inland rail

-

Protection from tariffs a feature of Australia and Hong Kong deal.

-

BMSB UPDATE 45 - WA Biosecurity Alert