Peak Season Demand - Myth or Fact?

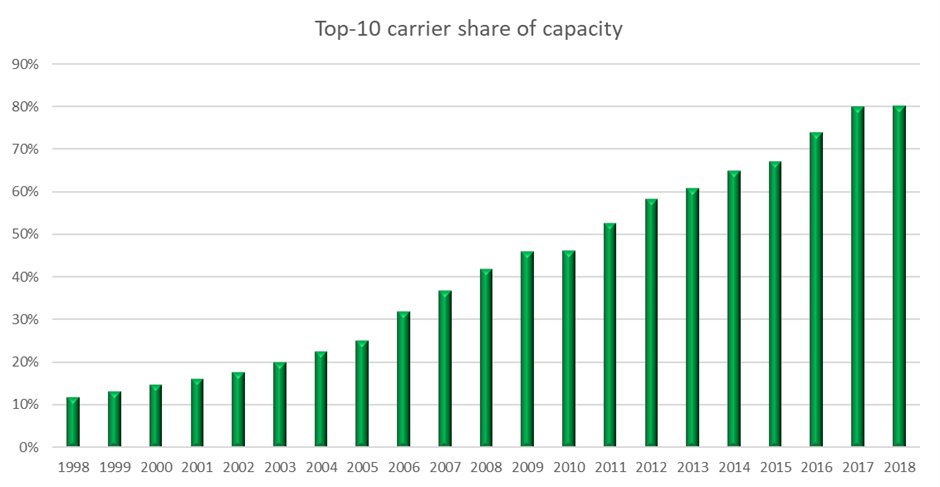

The rate of change in the international sea freight market has accelerated tremendously in the last few years. Over time, shipping line acquisitions and the formation of shipping alliances have culminated in a consolidation in the industry the likes of which have not been seen before. The past two decades have seen the top 10 carriers increase their share of total container capacity from 12% to a staggering 80% in 2018 (SeaIntelligence Consulting, 2019).

The resultant shipping oligopoly has no doubt touched virtually every shipper around the world. Schedules, capacity and price are now controlled by the few, leaving many shippers dealing with “blank” (i.e. cancelled) sailings leading to a mad rush for space causing congestion and ultimately forcing freight rates up.

Following years of industry consolidation, some may argue that supply and demand are being artificially controlled by the few shipping lines left. Control of supply ultimately impacts on the relative demand for the product. This principle is no different in international shipping and blank sailings have been used as an effective tool to achieve this end, the impact of which every shipper or consignee is feeling right now; namely congestion, delayed delivery and higher prices.

While blank sailings have been around for decades with individual carriers implementing them from time to time, they have never been used on a large scale to effectively control supply. As the top 10 carriers now have such a large share of total capacity, they can apply blank sailings to much greater effect. Consequently blank sailings have increased 10 fold in the last two years alone. No one is left to add capacity now if the top 10 withdraw it. This reality is playing out before our very eyes.

Traditionally, of course, there is a natural increase in demand for consumer goods in the Western world in the lead up to Christmas. But as growth in world economies has slowed in recent years and peak demand has diminished, shipping lines have been less successful than in the past at imposing peak season surcharges. However, by the large-scale use of blank sailings carriers are reducing capacity and increasing relative demand thereby enabling rate hikes which only add to the frustrations being experienced by shippers caused by delays and congestion.

The past two decades have seen the top 10 carriers increase their share of total container capacity from 12% to a staggering 80% in 2018

So what does it all mean? It means higher, albeit more stable, pricing as capacity is shaped to meet demand. In the meantime we are enduring haphazard sailing schedules, causing congestion and delays, while paying a price premium for an inferior service offering.

Most economies legislate to protect and defend competition to ensure quality products and services at reasonable prices. If shipping was any other ‘product’ one wonders if this would be allowed to happen!

So what does it all mean? It means higher, albeit more stable, pricing as capacity is shaped to meet demand. In the meantime we are enduring haphazard sailing schedules, causing congestion and delays, while paying a price premium for an inferior service offering.

Most economies legislate to protect and defend competition to ensure quality products and services at reasonable prices. If shipping was any other ‘product’ one wonders if this would be allowed to happen!

John Antoniou

Chief Executive Officer

-

Australian Governments Modern Manufacturing Strategy

-

Boxship owners see 13-year high in charter rates as carriers hunt for tonnage

-

DP World and UNICEF to support COVID-19 vaccine distribution

-

Buoyant ocean carriers set to roll out peak season surcharges months early

-

Trade protectionism a barrier to the recovery of global economies, warns ICS

-

Outlook for large widebody looks chilly in a hot freighter conversion market

-

EVEN AS THE WORLD STRUGGLES

-

Maersk to launch carbon neutral vessel

-

STATE PREMIERS URGED TO INTERVENE ON CROSS-BORDER ISSUES

-

PORT BOTANY RAIL DUPLICATION FAST TRACKED

-

Covid vaccine: is air cargo ready for 'the biggest product launch in history?

-

Logistics protests as Melbourne lockdown puts the brakes on supply chains

-

Demand driving transpacific prices sky high, with Asia-Europe benefiting too

-

Carriers follow through with capacity disicpline and blank more sailings

-

Indonesian Free Trade Agreement - economic opportunity opens up

-

Department of Agriculture turns away import vessel

-

Good Compliance Update - December 2019

-

Scale-less weighing of containers for SOLAS VGM

-

Patrick East Swanson Terminal Melbourne - Reductions in night shift road R&D operations

-

Shippers brace for delays as coronavirus keeps China's factories closed

-

Coronavirus containment measures and the impact on your China cargo.

-

2019/2020 Stink bug seasonal requirements

-

BAF calculator may help ease uncertainty over looming IMO 2020 fuel rule

-

From 15 to 5 in just a few years - shippers' declining choice of container carriers

-

Government money to boost Queensland export

-

Freight forwarding scam warning

-

Marine insurance case study

-

Australian Ports infrastructure not keeping up with global trends

-

Truckies heartened by support to stopping port surcharges

-

Victorian Transport Association (VTA) State Conference 2019 - Making the case for inland rail

-

Protection from tariffs a feature of Australia and Hong Kong deal.

-

BMSB UPDATE 45 - WA Biosecurity Alert